|

Came across this fantastic video on the modern banking system, the type of economies it can create, and the good a sound one can transform a society.

To all our friends and clients, Our office will be closed from 8th to 15th February during this festive period.

ISCA (Institute of Singapore Chartered Accountants) has just celebrated its 60th anniversary and our very own PM-in-waiting graced (yes, she was there too) the occasion. He gave an interesting speech about the profession and industry, and the transcript can be found here. Of particular interest was where he touched on the future of the profession, where he rightly noted the deteriorating state of our supply chain and how the root cause is fee driven: In fact, all corporate Boards and Audit Committees must appreciate and understand that value that audit brings to the business, value in terms of instilling discipline, deterring fraud, or upholding good corporate governance. In fact, all Board directors must be prepared to pay reasonable fees for quality audits, rather than try to keep fees as low as possible. His other insights into how to deal with these challenges while valid, fail to, IMO, deal with the elephant in the room.

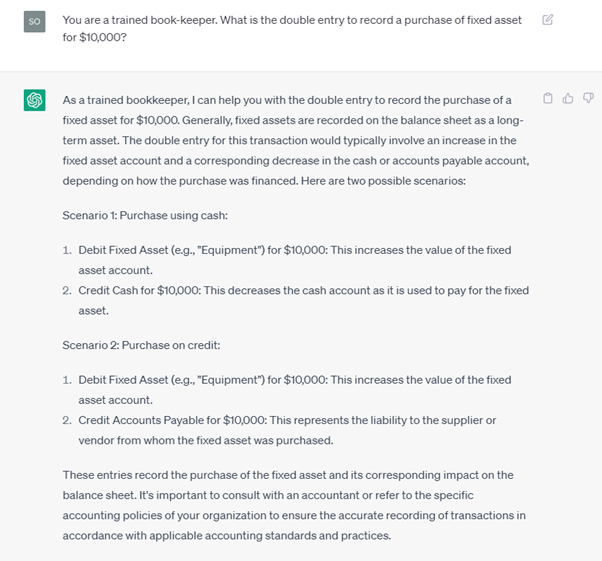

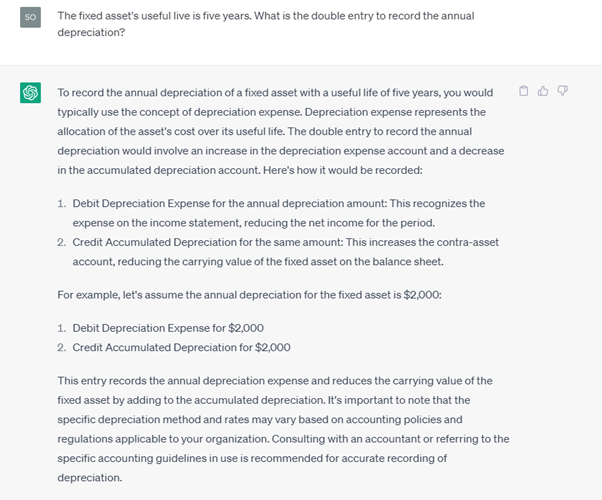

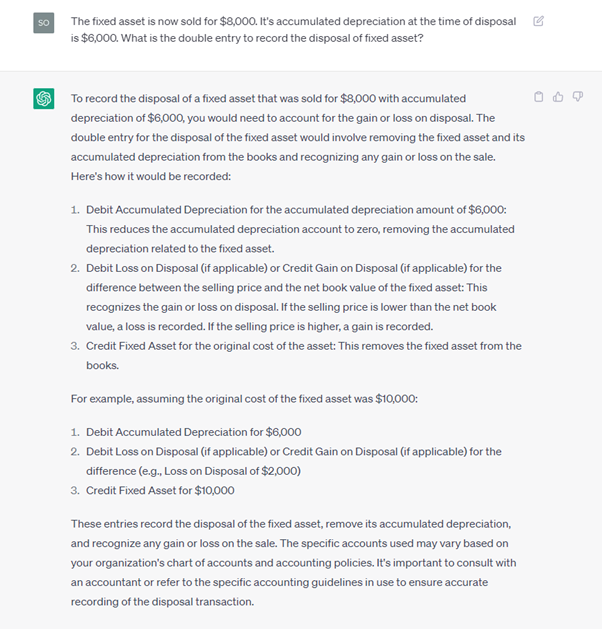

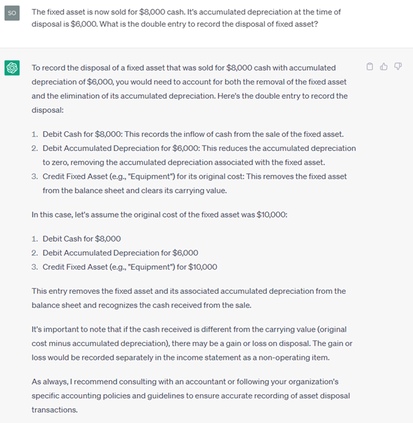

The new amendments to the Accountant's Act has just been passed, and for the 1,000 public accountants here, these new measures imposed greater penalties on us if we do not adhere to the higher standards mapped out. Public Accountants make up for less than 3% of Chartered Accountants (1k vs 34K) in Singapore, so the interesting point is that 97% of Chartered Accountants are not governed by this Act. And they are also not under equivalent legislature ever since we changed our designation from CPA (Certified Public Accountants) to Chartered Accountants in 2013. How this came about is that when we were CPAs, this Act applies to us all, i.e. both practising and non-practising. But when the designation was changed, the wording in the Act did not change, so now it applies to public accountants only. And that means all Chartered Accountants who are not Public Accountants suddenly do not fall under the Act. It's been a decade since the designation and pathways has changed and the climate we see now is a consequence of the decisions made back then. IMO, this change impacted the appeal of accountancy courses as the necessity of these courses to those who want to pursue the profession declined substantially compared to the previous pathway. Hence we are seeing a talent drain or "leakage" that has been slowly building up over the course of ten years. While that by itself is significant enough, another pertinent point is that a lack of legislative accountability (pardon the pun) on non public accountants also drove the quality of accounting in the industry down. It has been in my experience that very few accountants these days can draft a proper set of financial statements. Heck, I even saw a social media post describing financial statements as statutory accounts and how they are different from management accounts! (Yes, I can't even...) And to add insult to injury, the poor public accountant is now expected to deliver a higher quality audit when the quality of the accounts they are auditing continues to deteriorate. I believe these are the true challenges the public accounting profession face and as long as the elephant is still in the room, it is possible that we may no longer have space to breathe in the future. By now, I'm sure most of us would have known of Generative Pre-Trained Transformer (GPT) AIs. The AI wave is well and truly upon us and I must say, the pace of adoption and development is well beyond my initial expectations. I first started experimenting with ChatGPT in January this year. At first, I was very impressed with its cognition. So I was very excited and wanted to find out what it can or cannot do. But when I realised how smart it can be, I became a little scared. So you can say that I was excited and scared at the same time. And I mused to my friends that its like being in a new relationship. But I recognised how this was going to be a game changer and started evangelising it's usage to the people I know. So it was heartening to see at a recent event organised by my constituency, quite a number of people there have heard and are trying out GPT AIs. It has been suggested that AIs are threatening to replace certain jobs and professions. But I've opined previously where the accounting profession faced the "threat" of digitalization, cloud computing etc, that we should always look to see how technology can enable us rather than fear using it. So I did put ChatGPT through its paces to try and understand its limitations. And just like what John Oliver said in this episode of Last Week Tonight, "The problem with AI right now isn't that it's smart, it's that its stupid in ways we can't always predict" John Oliver, Last Week Tonight When GPT4 rolled out shortly after this episode, we finally caught a glimpse of one of the ways we can predict. OpenAI has acknowledged that while the AI would have a propensity to "hallucinate" its responses and answers, it would do so at a lesser frequency with GPT4. Which IMO is just a politically correct way to say it lies. The issue is, it lies quite convincingly. I've tossed some technical questions to it before and have experienced how it "hallucinates" its response after response before cratering to admit it was wrong. But I have domain knowledge so I could confidently challenge it response after response. Can the same be said for someone with no or little domain knowledge? And the fact is that its building up its capabilities more and more everyday. I'm sure you have seen reports on how it can already pass the Bar exams etc. So sooner or later, a lot of intellectual jobs would be under threat from AI. Case in point, software coding is very much disrupted by AI already since it can generate code faster than a human being. So the accounting profession is also, in its response when asked the question, very much under threat. I've decided to test the extent of this perceived threat and this is the result: So far so good for simple double entry. I then tested it further: Still spot on. Now for the ultimate test: The first query on the left omitted the information that it was sold for cash. And even with that information included in the second query on the right, the journal entries suggested is still incorrect. More importantly, these entries do not even balance. So based on this test, IMO, the profession is safe for now.

But if you look at its responses, it's quite convincing. I do doubt a person with less or minimal domain knowledge will be able to tell the difference. Possessing knowledge is thus important in not only in dealing with the possible threats from AI but also to detect misinformation from the use of AI. It's imperative for us to now gather as much knowledge as we can and maintain it. And since it is almost impossible to have domain knowledge in everything, we should learn to be skeptical in processing information to protect ourselves against misinformation in an increasingly AI-driven world. And this is why I think 2023 will be THE year the Knowledge Age starts in earnest and takes over from the Information Age. (In case you're wondering, this was not written by ChatGPT. But the images above were generated from AI) Warmest wishes to all of our valued clients and friends as we welcome in the Year of the Rabbit. May this year bring prosperity, good luck and happiness to all. We are grateful for your continued trust and support, and look forward to serving you again as we hop into the New Year!

Our office will be closed from 20 January 2023 to 24 January 2023. Wishing our friends and clients a peaceful holiday and a better year ahead! Please note that our office will be closed from 26th December 2022 to 2nd January 2023.

We are pleased to announce that we are now an ICAEW Authorised Training Employer! We look forward to shaping the minds of the next generation of accountants and difference-makers! Interested accountants can email us here: [email protected]

So, Musk tweets that freedom of speech is the bedrock of democracy. But in this day and age, “speech” is no longer the dominant medium of expressing one’s view. In the digital age, freedom of “speech” is more likely to be the bedrock of misinformation instead. The human mind has been long conditioned to take the written word as more of a Gospel truth compared to hearing them. We question very little of what we read, but it could take up to three different people telling us the same thing before we are convinced it is the “truth”. So when the written medium, though social media platforms, becomes the dominant form of expression of views and opinions, such views and opinions are more susceptible to being accepted.

And we have seen how fake news and misinformation have proliferated our social media platforms. This is largely due to the providers of such platforms not spending enough resources to fact check content that are driving them “eyeballs” revenue. In fact, one could argue it would make more sense for them for such contents to be more sensational and controversial to drive eyeballs instead of establishing the boring truth. Hence, such conditions prove ripe for misinformation today. But to rule out this freedom of "speech" would also not be acceptable in less totalitarian regimes. What is our defence then? Well, how about, caveat lector – let the reader beware. And it's importance should even outweigh that of caveat emptor in this digital age. We need to start training our minds to be skeptical on the things we read, down to even the “comments” level. And with the steady erosion of journalistic integrity, this should also include content from the traditional news sources. Yes, I'm afraid becoming more cynical is sadly our only defence for now. But, on the bright side, we can now welcome you into our world; the world of professional sceptics. We are pleased to announce that we are now a silver partner of Xero! It's been an exciting journey for us so far and we continue to recommend Xero to our clients over its competitors. Contact us now to find out more why Xero is our preferred choice!

May it be a roaring one for all of us!

Our office will be closed from 31 January 2022 to 4 February 2022. While contemplating the proposed new amendments to the Accountants Act, it suddenly dawned on me that currently, the Act only applies to public accountants. While this might not seem strange at first, one must remember how the profession have changed it's designation over the years.

As explained in our previous post, there was a time when we were all known as certified public accountants (CPAs) and the Accountants Act back then applied to all of us, whether we were practising or non-practising CPAs. Fast forward to today, the segregation between practising and non-practising CPAs is via the designation of Public Accountant (PA) and Chartered Accountant (CA) titles respectively. But yet the terminology in the current Accountants Act had not change and merely mentions and defines "public accountant" only. I daresay this means that CAs are no longer governed by the Act now. But in the past, they were when they were still known as non-practising CPAs. Surely this must be an oversight! Surely it cannot be the intent of the powers that be to have CAs operate outside any legislation? With this in mind, I tabled a motion for a group of PAs to consider including in their feedback on the proposed amendments to legislate CAs to be back in the Act again. Until this is done, it will appear that it is far easier to be a CA in Singapore as they are being made different by being outside the law; a true difference maker indeed. We are proud to announce that "Echtual" is now a registered trademark! We would like to thank all our clients for their support in helping us reach this milestone. Moving forward, we will continue to provide the same efficient, reliable and true quality service Echtual is known for in all our services; namely accounting, audit, tax, advisory and valuation services.

Looking for a service provider that keeps it real? Look no further and contact us today! |

CuratorEchtual Archives

May 2024

Categories |

实际会计师事务所有限公司

Copyright © 2016 // ECHTUAL®

5 Temasek Boulevard #17-131 Suntec Tower 5 Singapore 038985

t: +65 6513 5871

t: +65 6513 5871

RSS Feed

RSS Feed