|

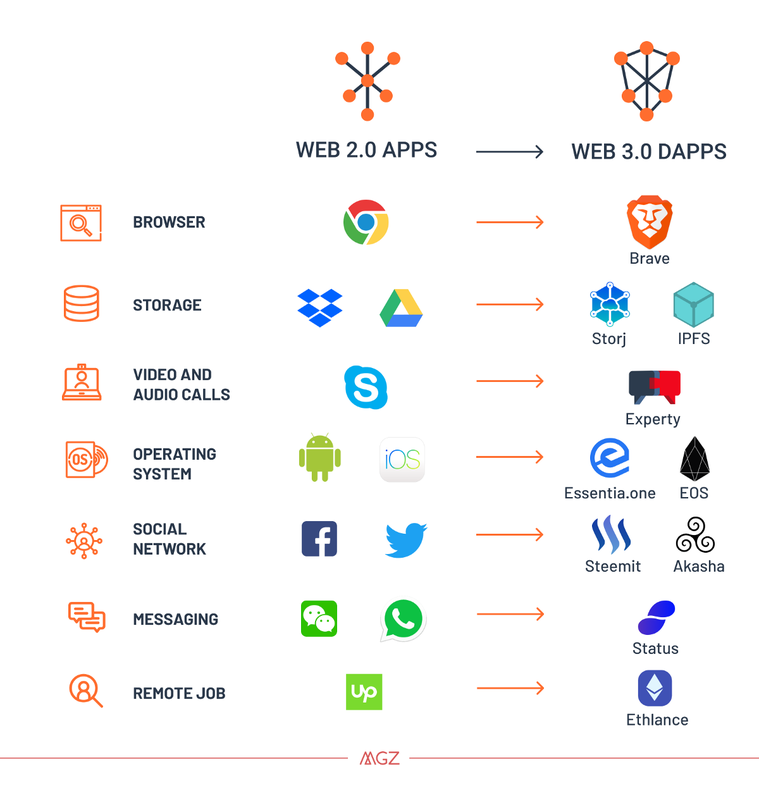

With today's focus on big data and data analytics, it is perhaps surprising to know that it is possible to fight against the monopolization of data.. As this article (Why the Web 3.0 matters and you should know about it) relates, "The next web, they envisaged, would take nostalgic turn to the vision of the web 1.0: more ‘human’ and more privacy. Rather than concentrating the power (and data) in the hands of huge behemoths with questionable motives, it would be returned the rightful owners." The article then highlights the new apps that are poised to take over the existing ones :

With the brouhaha surrounding Facebook and Cambridge Analytica, China's social credit score system, such developments are heartening news indeed. As much as all things internet are now very much a part of the fabric in society, to know that we can avoid being slaves to the system is a very big deal. How is this done? The answers seems to be this : "For access to the decentralized web, people will only need a seed. This will be a single asset which enables the interaction with dApps and other services. Individuals will still use a web browser to access the internet, and visually it will be Web 2.0 user-friendly." But at present the decentralized apps, wallets, platforms, and other digital assets that make up Web 3.0 are scattered. And accessing these interfaces calls for separate seeds, logins, and identities — much like the existing Web 2.0. So the author, the founder of Essentia.one, offers to be the provider of the single seed. The irony is, while having a single key to access all things internet is great for the user, we are back to the original issue of monopoly. If there is only one provider providing these seeds, then all power will be concentrated on the one providing the seeds.

Wouldn't we be just replacing the current behemoths with just another version? Came across this interesting article today and am guilty of quite a few of them. The first 7 relate to office productivity and the rest is more on the personal level. In summary, here's the 12 poor decisions you could be making on a day to day basis :

Even as some companies are still reeling from the adoption of FRS 115, the next big standard to affect the accounting landscape is FRS 116. This will be a major accounting standard to adopt for lessees.

In a nutshell with this new standard, there is no more distinction between operating and finance lease accounting for lessees. What this means is that leased assets and liabilities that were off balance sheet under FRS 17 (the previous standard) will now have to be recognised. Needless to say, the impact on the financial statements as a result of this change could be potentially huge, especially if the company has lots of operating leases. Impact on Statement of Financial Position The company’s assets and liabilities will increase and this would affect ratios like current ratio and gearing ratio negatively. In all likelihood, the current ratio will decrease as the lease liability recognise would affect both current and non-current liabilities but the lease asset recognised will only affect the non-current asset section. Gearing ratio would also increase as financial liabilities is increased and equity is decreased due to increased expenses recognised (depreciation and lease interest). Companies relying on these ratios to determine or maintain debt covenants would do well to pre-empt these changes and negotiate with their bankers now to avoid breaching their debt covenants. Impact on Income Statement As mentioned above, ceteris paribus, a company’s overall profits would decrease upon adoption of FRS 116. This is due to increase in depreciation and interest expense, which would likely outweigh the effect of the absence of the now disallowed rental expense. An interesting consequence, however, is that EBIT and EBITDA would increase as the additional depreciation expense should be lesser than the disallowed rental expense. Companies that use these ratios for staff incentive programs would need to take note of these impact and revise their KPIs accordingly. Similarly, companies who report these ratios to their investors should also inform them of these impacts and decide if their current benchmark needs to be revised. Impact on Cash Flow Statement The impact on operating cash flow would be positive as the rental expense amount is no longer in this section and the newly included interest payment would be much smaller in comparison. This is because the bulk of the cash outflow is now the principal payment and that would belongs to the financing section. Companies may wish to educate their investors that the increase in operating cash flows does not really indicate any vast improvement in the business as the net cash flow is unaffected. Conclusion Even though the effective date for this Standard is 1 January 2019, companies that have heavy operating lease commitments should start assessing the impact now rather than in 2019., In particular, companies in the co-working and service office industry like WeWork and Regus could be very much affected by this standard, especially if they don't own the properties they operate in. For companies with debt covenants tied to gearing ratios, they should start negotiating with their financial institutions to avoid situations where those covenants would be breached. Companies who are using the affected ratios for benchmarking should also assess the impact of these changes and make their own revisions accordingly. If you need assistance in assessing the impact of adopting this Standard on your Company, we can help! Contact us today! |

CuratorEchtual Archives

May 2024

Categories |

实际会计师事务所有限公司

Copyright © 2016 // ECHTUAL®

5 Temasek Boulevard #17-131 Suntec Tower 5 Singapore 038985

t: +65 6513 5871

t: +65 6513 5871

RSS Feed

RSS Feed