|

Always wondered if your company's financial statements and accounting records needs to be audited? Find out more about the statutory audit and other financial audit requirements in Singapore here.

Looks like the audit industry in Britain is headed for a shake up after the accounting scandals like BHS and Carillion in the previous years.

Today reported on the changes that would be proposed and the most interesting one would be that of making directors responsible for detecting fraud. It was only just last year that the idea of revising audit standards so that auditors are responsible for detecting fraud was bandied around. This change from Britain, if passed, would definitely be an impact on how the International Audit Standards would be changed. Interesting enough, one wonders if Britain deliberately waited until Brexit was a done deal to make these changes. There would certainly be less consensus sought from their European counterparts now that Britain is no longer part of the Union. On a lighter note, their Financial Reporting Council is being renamed to Audit, Reporting and Governance Authority or ARGA for short. One can say, arga arga, theirs now sound like our ACRA... Please be advised our office will be closed from 11th February to 15th February 2021 for the festive period.

and hopefully, a happier New Year. As 2020 draws to a close, we would like to thank our clients and friends for their wonderful support during these unprecedented times. We look forward to serving you in a covid-free (hopefully) 2021! Our office will be closed from 24 December 2020 to 28 December 2020.

Our office will be closed tomorrow due to Polling Day.

We will resume operations on Monday, 13 July 2020. What is Peppol e-invoicing?

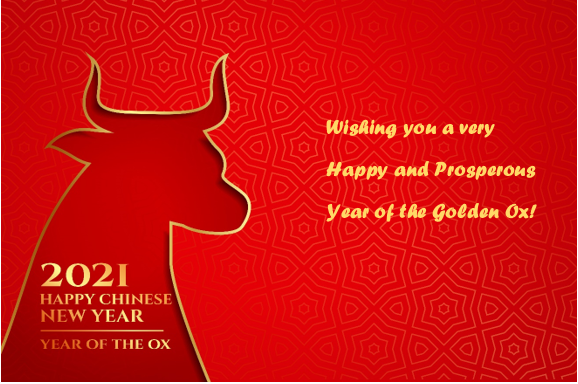

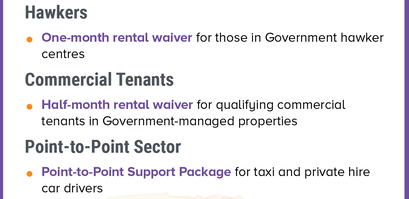

Peppol E-invoicing is a standardised digital way of sending and receiving invoice between the accounting systems of two parties, regardless of the type of software they use. Peppol is the network that facilitates the exchange of this information digitally. Does E-invoicing mean online invoicing? No E-invoicing is different from online invoicing. In most current business scenarios, online invoicing refers to either a scanned copy of the invoice or a PDF file sent to the recipient organisation via email. The process relies on manual data entry as your recipient will have to re-enter the details of the invoice into his own accounting system (e.g. accounts payable). Similarly, you may be receiving many online invoices in the form of PDFs – you will also need to have someone manually input the invoice details or scan the pages of invoices into your system. E-invoicing on the other hand is an invoice created digitally in a supplier’s financial system, transmitted electronically through the Peppol network to the recipient (buyer) where it is processed automatically without any human intervention. For example, E-invoices received in a PEPPOL Ready accounting solution can appear as draft bills automatically without any manual data entry. Free on Xero! Xero can now connect to the Peppol E-invoicing network launched by the Infocomm Media Development Authority of Singapore to speed up your invoicing process. It can get you paid faster by your customers and help you maintain healthy cash flow in your business. Best of all, it comes free with your Xero subscription! Contact us now to start getting paid faster! On the back of an economic slow-down made worse by the Covid-19 virus epidemic, this year's budget was highly expected to give a significant boost to the ailing Singapore economy. And with the largest budget deficit in ten years of S$10.9B, it can be said that this was what it sought out to do. A summary of the measures can be found in the table below (source : Ministry of Finance) : Apart from the belated "ang bao" ($100-$300 cash) to every Singaporean,the following three initiatives in the Budget are of the greatest impact to businesses: 1. Sending Coal In The Midst of Harsh Winter (雪中送炭) The businesses hit by the ongoing epidemic are largely in tourism, food & beverage and transport industries. So it is heartening to see the Budget giving relief to these sectors through the following measures : Although rental and property tax rebates does not seem like much compared to an outright cash rebate, it is still some measure of relief to affected businesses..

2. Other Band Aids There are also other measures tailored to support workers and enterprises :

These measures are also expected to help alleviate cash flow issues faced by businesses. 3. Seizing Opportunities Chinese believe that there is opportunity in a crisis ("危机") and Singapore is sizing up opportunities arising from the following trends :

While it's true that some of the measures are not as significant when compared to those implemented during the SARS crisis, this is a reflection that the current crisis is not considered to be as bad as SARS, Should this not be the case, the G has reserved enough gas in the tank to implement more measures. The management of Echtual will like to wish all our clients a very Happy New Year!

We will like to thank all of you for your wonderful support and we look forward to serving you again in 2020! A friend recently asked me how SoftBank can get away with not reporting WeWork's massive losses in its books if it is treated as an associate rather than a subsidiary.

I told him much of the rationale comes from an accounting rule called "equity accounting" and this article briefly explains how this is done. But what the article didn't expound on is the concept of "de facto" control, which is the principle behind the reason why an entity holding an 80% stake in another entity gets to classify it as an associate rather than a subsidiary. In this case, majority of the voting power now lies with WeWork's board, and SoftBank says they don't have majority of the board of directors, and therefore, no de facto control. However, if they have the power to appoint and remove directors from the board, it would be hard to prove that they really don't have "de facto" control. Having issues grappling with the concept of "de facto control"? Speak with the Echtual Experts today! One major headache of an ICO has always been how to mange the tax burden of the proceeds. If not managed properly, an entity not only faces an income tax charge upfront of the entire proceeds that is meant to fund a few years of development, but also reverse charge on GST on the proceeds if the stipulated threshold are met (assuming the customer was not charged GST on the onset during the sale of tokens).

Truth be told, GST is not an easy area to navigate for ICOs and one which most entities fail to address before the launch. So its great to see that IRAS has come up with a draft e-tax guide on GST on Digital Payment Tokens, In this guide, IRAS also address some of the more complicated issues (e.g. determining belonging status of customers). Key takeaways from the proposed changes :

A helpful summary of the changes can be found in Appendix A of the guide. IRAS is also currently inviting feedback on these changes and we urge all stakeholders to weigh in on these changes as soon as possible. We are proud to announce that we are now a Benefits Partner of Doerscircle!

Doerscircle is the first platform uniting self-employed people for better conditions. Read more about them here. KPMG just announced that they are planning to create an independent audit firm regardless of any decision by the British regulators to break-up the Big Four accounting firms.

We first took note of this development last year and it looks like the British regulators are serious about shaking up the Big Four to improve independence in the industry. If this sounds familiar its because we have seen this before; back in the days of the Enron scandal which resulted in the existing big accounting firms segregating their consulting arm from the main audit business. But in the years that followed after that, it seems like this they have slowly reverted back to pre-Enron days. It would be interesting to see how this develops and how it would affect the accounting industry. It has been a long time waiting, but OCBC bank feeds are finally available for Xero! With OCBC joining the ranks, Xero now has bank feeds for ALL the local banks.

So what are you waiting for? Sign up with us now before 15 March and enjoy big discounts off your subscription for 12 months! Wishing all our clients and friends a very Happy and Prosperous Year of the Pig!

Our office will be closed from 4 February to 7 February 2019 during this festive period. |

CuratorEchtual Archives

December 2023

Categories |

实际会计师事务所有限公司

Copyright © 2016 // ECHTUAL®

5 Temasek Boulevard #17-131 Suntec Tower 5 Singapore 038985

t: +65 6513 5871

t: +65 6513 5871

RSS Feed

RSS Feed